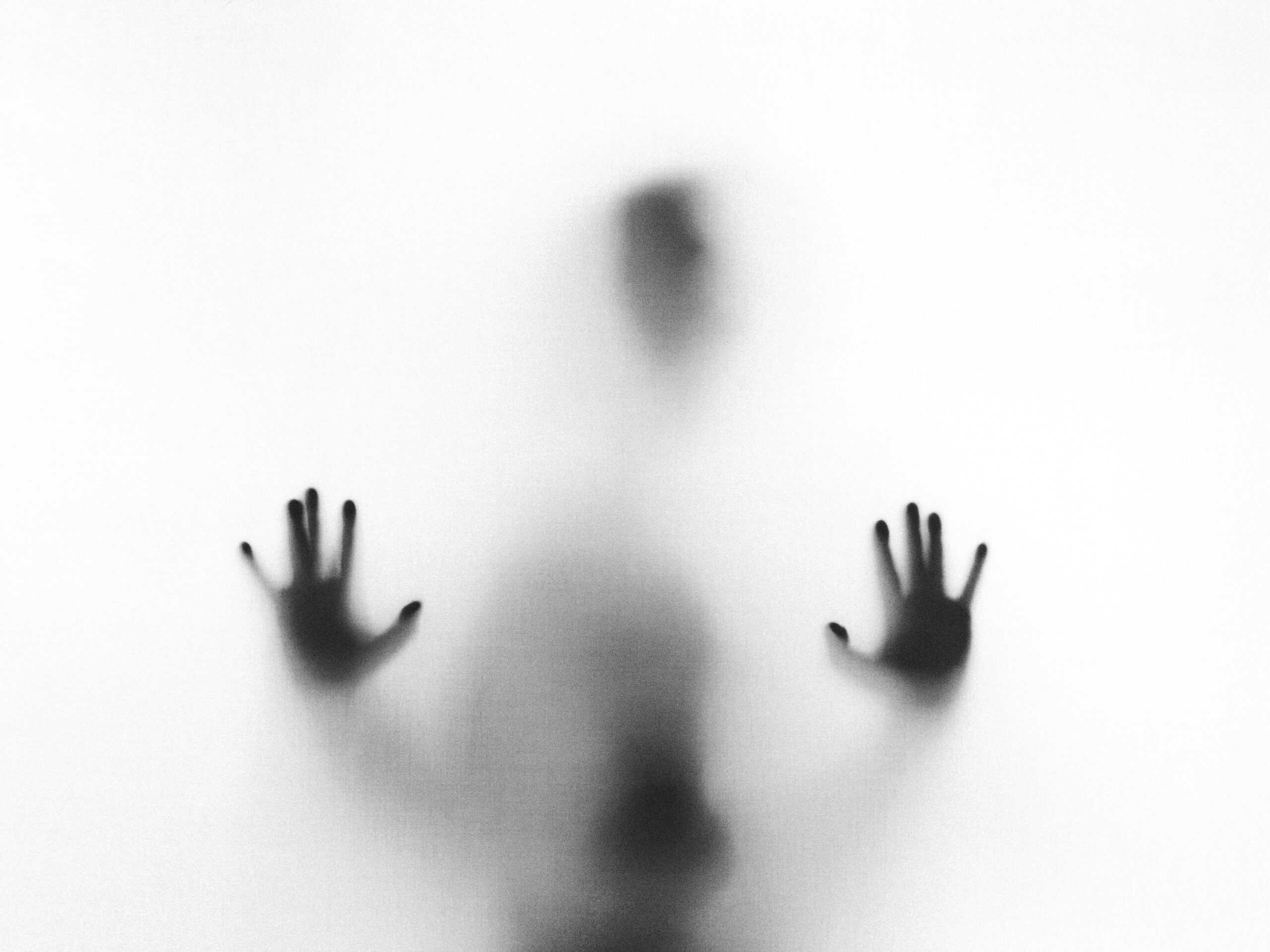

Ah, the nostalgic chills of youth! Do you remember your first? I’m not talking about your first kiss or even the first time you drove a car. I’m reminiscing about that shiny piece of plastic, that key to monetary freedom – my very first credit card. It whispered sweet promises of endless shopping sprees and nights out, but little did I know, it would also lead to some haunting memories.

A Ghoulish Beginning

When I first laid eyes on that gleaming card, embossed with my name and adorned with a shiny chip, I felt a sense of accomplishment. The world had recognized me as an adult, someone who could be trusted with credit. Little did I realize, with great credit comes great responsibility.

The first few weeks were euphoric. Dinners out? Absolutely. That new pair of boots? Why not? Birthday gifts for friends, movie nights, and yes, even that spontaneous weekend getaway. Everything seemed within reach. The card was like a magic wand, and I felt like the wizard of my domain.

The Spooky Spiral

It wasn’t long before the once welcoming numbers of my monthly statement began to morph into monstrous figures. Like a phantom in a horror movie, the balance grew larger and more intimidating, casting a shadow over my once carefree spending.

I remember the fateful night vividly. A chilly October evening, I logged into my bank account, expecting the usual manageable balance. But what stared back at me was a terrifying number. I had maxed out my card! My heart raced, and cold sweat formed on my brow. How had I let this happen?

Haunted by Minimum Payments

Like many haunted souls before me, I believed paying the minimum amount was the way to go. “It can’t be too bad,” I had thought. But as the interest accrued, I felt like I was trapped in a never-ending maze, with the exit just out of reach.

And then there were the late fees. Those pesky spirits that came to haunt if you missed the deadline by even a few hours. Each fee felt like a chain added to the weight I was dragging around.

Exorcising My Demons

Determined to break free, I armed myself with knowledge. I dived deep into the world of personal finance, learning about interest rates, debt snowballs, and the importance of timely payments. I cut down on frivolous expenses, started budgeting, and focused on paying off more than the minimum amount.

Slowly but surely, the monstrous balance began to dwindle. It was a hard-fought battle, with many sacrifices along the way. But the day I paid off that card in full, I felt a weight lifted. The ghost of my first credit card was finally laid to rest.

Lessons from the Grave

If there’s one thing this haunting experience taught me, it’s that credit cards aren’t inherently evil. They’re tools. And like any tool, they can be beneficial when used correctly. But they can also lead to some terrifying situations if not handled with care.

So, dear reader, let my tale be a cautionary one. Embrace the freedom that credit cards offer but tread wisely. And always, always read the fine print. Because sometimes, the real demons lurk in the details.

GOOGL

GOOGL  META

META

Leave a Comment